11 Sep How much automobile insurance coverage do I need?

In my career, I have reviewed countless insurance policies and declaration pages. A common theme I typically notice is people are under-insured, meaning they do not have enough automobile insurance coverage. I wanted to use my insurance policy to explain some of the coverage options and provide my loyal readers the opportunity for a free insurance review to ensure you have the appropriate level of coverage to protect you and your family. I do not sell insurance but I can at least help you determine what you should ask your insurance agent. I only listed a few types of coverage below, but please let me know if you have questions about other types of coverage.

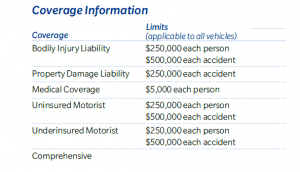

Bodily Injury (BI) Liability – I have $250,000 per person and $500,000 per accident. That means, in the event I get into an accident, an injured person could receive no more than $250,000* for their injuries. If there are multiple people in the vehicle, the maximum my insurance policy will cover is $500,000 total. For the average person, this is sufficient coverage unless there are catastrophic injuries.

*I also carry an umbrella policy, which costs me $299 for the year. This is very cheap coverage for piece of mind. In the event an accident causes greater harms and losses than my policy limits, the umbrella policy kicks in and covers up to the limits.

Property Damage (PD) Liability – the maximum my insurance will pay is $250,000, which will cover a vast majority of vehicles on the road in St. Louis. For most people, $50,000 is sufficient, however, insurance companies charge a nominal increase to go from $25,000 to a higher amount, most likely because they know most vehicles are under $50,000.

Medical Payments (MP) Coverage – this is no fault medical that your insurance company will pay each person in your vehicle in the event anyone is injured. For instance, if I rear-end someone and my passenger and I both get hurt, even though the accident was my fault (hence the no fault aspect), my passenger and I could claim up to $5,000 in medical against my insurance. Many people have no idea they have this coverage on their policy and forget to use it. This is especially helpful in cases where a person is injured by another. A person’s medical payments can cover some of the bills while the person waits for a settlement against the at-fault party.

Uninsured (UM) Coverage – unfortunately, we are seeing more uninsured drivers throughout town. If you get hit by someone who is not insured, your insurance company steps into the shoes of the at-fault person’s insurance and provides coverage. For the property damage portion, you would need full coverage and end up paying your deductible, but for the injury portion, your insurance company will provide coverage. Every policy in Missouri automatically has the state minimum of $25,000/$50,000.

Underinsured (UIM) Coverage – this is additional coverage through your insurance company in the event you are hit by someone who does not have enough insurance coverage for your claim. For instance, if I was hit by someone with the state minimum, which is $25,000, but my claim was worth $75,000, I would seek the remainder ($50,000 in this example) from my own insurance company. While others may not have adequate coverage, it is important to have enough coverage of your own to protect against catastrophic injuries.

Sorry, the comment form is closed at this time.